What You Must Know About the Different Parts of Medicare

Medicare can be complicated but we've got you covered. Here is a quick guide to the different benefits provided through each part.

Medicare can be complicated, especially if you are a new enrollee or someone checking their plan during the Medicare open enrollment period, which is currently underway. Keep in mind that open enrollment will close in less than a week on Thursday Dec. 7.

It's important to understand what benefits you will receive so you can decide if you want prescription drug coverage, an Advantage plan or additional coverage through Medigap. Below is a quick explanation of each part of Medicare.

If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain facilities or for patients with certain conditions.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Medicare Part A

Part A covers inpatient care at hospitals and skilled nursing facilities as well as hospice and some home health care. If you paid Medicare payroll taxes for at least 40 quarters, the Part A premium is free. For 2024, there is a deductible of $1,632. You also must pay coinsurance for hospital stays longer than 60 days. For more details, read What You’ll Pay for Medicare in 2024.

Medicare Part B

Part B pays for doctor visits, outpatient care and some home health care. For 2024, the deductible is $240 and the base premium is $174.70 per month. After hitting the deductible, you pay 20% of expenses unless you have either Medicare Advantage or supplemental coverage.

The penalty for failing to enroll at age 65 is a permanent 10% of the monthly premium multiplied by the number of years you could have enrolled but didn't. Exceptions are made for those with coverage through a qualifying employer health plan.

Medicare Part C

Part C is commonly called Medicare Advantage. Beneficiaries are covered for Parts A and B through private insurers instead of traditional government-administered Medicare. Most Advantage plans include prescription drug coverage. For 2024, the average monthly premium is $18.50.

Medicare Part D

Part D refers to standalone prescription drug coverage through private insurers. If your Advantage plan includes prescription drugs, you don't need Part D. If you elect original Medicare and want medications covered, you will need a Part D plan. Modern Medigap plans don't cover prescription drugs, but if you purchased a policy before Jan. 1, 2006 and still have that plan, then your Medigap policy may include drug coverage.

The average total monthly premium for Medicare Part D coverage is projected to be approximately $55.50 in 2024.

If you decide after your initial enrollment period that you want Part D, you will pay a permanent 1% penalty of the base premium multiplied by the number of months that you went without the coverage.

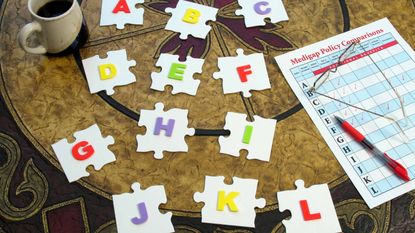

Medigap

Supplemental coverage is commonly referred to as Medigap. This is private insurance to supplement original Medicare coverage. The plans cover part or most of the cost sharing, such as coinsurance and co-payments, for Parts A and B, depending on which lettered Medigap plan you choose.

There are 10 plans but as of 2020, new Medicare enrollees are ineligible for Plans C and F. All plans with the same letter provide the same benefits but the cost could vary by insurance company.

Medigap plans typically have higher monthly premiums than Advantage plans but lower out-of-pocket expenses.

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jackie Stewart is the senior retirement editor for Kiplinger.com and the senior editor for Kiplinger's Retirement Report.

- Donna LeValleyPersonal Finance Writer

-

Rent a Luxury Pool This Summer With Swimply — the Airbnb of Pools

Rent a Luxury Pool This Summer With Swimply — the Airbnb of PoolsWith Swimply, you can live it up at a luxury pool while escaping the heat and going for a swim.

By Erin Bendig Published

-

The Secret Credit Card for Amazon Prime Day Shopping

The Secret Credit Card for Amazon Prime Day ShoppingThis "secret" credit card for Amazon Prime Day shopping can maximize your cash back rewards. Plus get a $300 bonus.

By Erin Bendig Published

-

Medicare Basics: 11 Things You Need to Know

Medicare Basics: 11 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

By Catherine Siskos Last updated

-

Six of the Worst Assets to Inherit

Six of the Worst Assets to Inheritinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

By David Rodeck Published

-

403(b) Contribution Limits for 2024

403(b) Contribution Limits for 2024retirement plans Teachers and nonprofit workers can contribute more to a 403(b) retirement plan in 2024 than they could in 2023.

By Jackie Stewart Published

-

SEP IRA Contribution Limits for 2024

SEP IRA Contribution Limits for 2024SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $69,000 a year.

By Jackie Stewart Last updated

-

Roth IRA Contribution Limits for 2024

Roth IRA Contribution Limits for 2024Roth IRAs Roth IRA contribution limits have gone up for 2024. Here's what you need to know.

By Jackie Stewart Last updated

-

SIMPLE IRA Contribution Limits for 2024

SIMPLE IRA Contribution Limits for 2024simple IRA The SIMPLE IRA contribution limit increased by $500 for 2024 and workers at small businesses can contribute up to $16,000 or $19,500 if 50 or over.

By Jackie Stewart Last updated

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

By Jackie Stewart Published

-

Roth 401(k) Contribution Limits for 2024

Roth 401(k) Contribution Limits for 2024retirement plans The Roth 401(k) contribution limit for 2024 is increasing, and workers who are 50 and older can save even more.

By Jackie Stewart Last updated