If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Anyone shocked by NVDA's wild ride should know that volatility has always been the price of admission to this long-time market beater.

Nvidia (NVDA) cemented its place as the market's favorite pure-play bet on artificial intelligence (AI) a year ago, and it shows no signs of letting up.

Seemingly insatiable demand on the part of AI data centers for Nvidia's graphics processing units (GPUs) propelled NVDA stock past $1 trillion in market capitalization midway through 2023. It took only about eight months for yet another blowout quarterly earnings report to push Nvidia stock past the $2 trillion mark.

Cut to today and Nvidia's over-the-top Q1 earnings – plus a NVDA stock split and a dividend hike – pushed its market cap past $3 trillion. Nvidia even briefly topped Microsoft (MSFT) as the world's most valuable publicly traded company.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But then long-time shareholders should be used to such outsized risks and rewards by now.

That's because volatility has always been the price of admission to this long-time market beater. True, Nvidia, a highly cyclical semiconductor stock, has vastly outperformed the broader market since going public at the end of the last century.

Quite naturally, it has done so with several vertiginous ups and downs along the way.

But before we take a look at Nvidia stock's illustrious past, let's recap how it's been doing recently.

After losing half its value in 2022 – and attracting some bargain-hunting billionaire investors around its share-price nadir – NVDA stock more than tripled on a price basis in 2023, vs a gain of 24% for the S&P 500.

And as for the year-to-date through late June? Nvidia stock gained more than 150% vs a 14% rise in the broader market.

Nvidia stock's market-beating ways go much farther back than most folks might know, however. In fact, few stocks have done more for investors over the past few decades than Nvidia. From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other factors, Nvidia is one of the 30 best stocks of the past 30 years.

Looked at another way, over its life as a publicly traded company, Nvidia stock generated an annualized total return (price change plus dividends) of 37.2%. The S&P 500, with dividends reinvested, returned an annualized 10.5% over the same period.

Importantly, most of the shareholder wealth generated by Nvidia came over just the past few years. That's because back in the day, the primary market for Nvidia's GPUs consisted of PC and console video game enthusiasts.

Happily for Nvidia, it just so happens that the company's powerful GPUs and related intellectual property are indispensable to the fields of artificial intelligence, professional visualization, cryptocurrency mining and more. As noted above, NVDA processors are in demand for use in data centers – and especially data centers that power generative AI. Indeed, the company is struggling to keep up with demand.

Few blue chip stocks offer so much exposure to so many emerging endeavors, which helps explain NVDA stock's amazing returns over the longer haul. More recently, AI has been NVDA's afterburner.

But as remarkable as the company's business may be, it doesn't quite get to the heart of what NVDA stock has meant to long-term shareholders and their brokerage statements. For that, consider the following facts about Nvidia stock.

The bottom line on Nvidia stock?

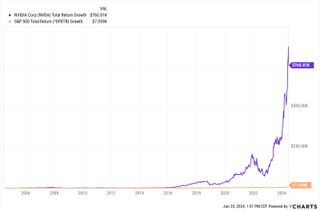

Over the past two decades, Nvidia stock generated an annualized total return of 39.4%. The S&P 500, by comparison, generated an annualized total return of 10.3% over the same span.

What does that mean in dollar terms? Have a look at the above chart and you'll see that if you invested $1,000 in Nvidia stock 20 years ago, it would today be worth more than $760,000. The same amount invested in the S&P 500 would theoretically be worth about $7,000 today.

As for adding to NVDA at current levels, the Street remains bullish even after the stock's incredible run.

Of the 55 analysts issuing opinions on Nvidia stock surveyed by S&P Global Market Intelligence, 42 rate it at Strong Buy, nine say Buy and four call it a Hold. That works out to a rare consensus recommendation of Strong Buy. Indeed, Nvidia ranks among analysts' top S&P 500 stocks to buy now.

Just remember that NVDA is a ultimately a chip company. The semiconductor industry is cyclical. Once everyone who needs AI chips has them, Nvidia's growth prospects could change.

More Stocks of the Past 20 Years

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade stocks or other securities. Rather, he dollar-cost averages into cheap funds and index funds and holds them forever in tax-advantaged accounts.

-

Stock Market Today: Markets Surge on Dovish Remarks From Powell

Stock Market Today: Markets Surge on Dovish Remarks From PowellThe S&P 500 topped 5,600 for the first time ever, boosted by mega-cap tech stocks.

By Dan Burrows Published

-

Project 2025 Tax Overhaul Blueprint: What You Need to Know

Project 2025 Tax Overhaul Blueprint: What You Need to KnowTax Proposals Some people wonder what Project 2025 is and what it suggests for taxes.

By Kelley R. Taylor Last updated

-

Stock Market Today: Markets Surge on Dovish Remarks From Powell

Stock Market Today: Markets Surge on Dovish Remarks From PowellThe S&P 500 topped 5,600 for the first time ever, boosted by mega-cap tech stocks.

By Dan Burrows Published

-

Stock Market Today: Markets Hover Near Record Highs on Powell Testimony

Stock Market Today: Markets Hover Near Record Highs on Powell TestimonyStocks were little changed on light volume as the Fed chief testified before Congress.

By Dan Burrows Published

-

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings Loom

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings LoomStocks wavered on light volume ahead of a busy week for economic news and corporate earnings.

By Dan Burrows Published

-

Five Stocks With Solid Growth History and a Promising Outlook

Five Stocks With Solid Growth History and a Promising OutlookFive reasonably priced stocks with solid growth history and a good chance of delivering earnings even if the economy softens.

By Kim Clark Published

-

Why You Should Invest in Commodities

Why You Should Invest in CommoditiesThese portfolio diversifiers are in a long-term uptrend and show why you should invest in commodities

By Anne Kates Smith Published

-

Now's a Great Time to Build a Bond Ladder

Now's a Great Time to Build a Bond LadderNavigating how to proceed with new or rollover money can be daunting. Here are some of the best ways to guarantee a high yield to maturity and full recovery of principal.

By Jeffrey R. Kosnett Published

-

What's the Most Popular Investment? These Investors Might Be Missing Out

What's the Most Popular Investment? These Investors Might Be Missing OutThe most popular investment may shock you and it has widely underperformed other asset classes. Here’s what you need to know.

By Joey Solitro Published

-

Stock Market Today: S&P 500 and Nasdaq Hit Records as Jobs Growth Slows

Stock Market Today: S&P 500 and Nasdaq Hit Records as Jobs Growth SlowsAn uptick in the unemployment rate amid a cooling labor market could accelerate the Fed's rate-cut timeline.

By Dan Burrows Published