All 30 Dow Jones Stocks Ranked: The Pros Weigh In

The Dow Jones Industrial Average comprises 30 blue-chip stocks that are tops in their industries. But some Dow Jones stocks are better buys than others.

You can't beat Dow Jones stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market.

Case in point: the S&P 500 generated a total return of about 27% over the past 52 weeks through late May, while the tech-heavy Nasdaq Composite, which is both riskier and "growthier," gained 32%. The Dow Jones Industrial Average, by comparison, very much lagged the pack. The elite bastion of 30 mostly mature industry leaders delivered a comparatively poky total return of 19%.

To be sure, that's a very good year on an absolute basis: the Dow's annualized total return over the past three decades comes to a bit more than 10% before inflation.

And yet the fact remains that the Dow is lagging the S&P 500 and Nasdaq by painfully wide margins in the current bull market.

It's important to know that the Dow's recent underperformance isn't abnormal. More than half of the average's components are low-beta stocks. That means they tend to lag in up markets, but hold up better when everything is selling off. This low-beta skew can actually be quite advantageous to long-term investors.

After all, as bright a time as it's been for equity investors, downside risks very much remain. Economists generally expect growth to slow, and some surveys put the odds of recession hitting in the next year at 40%. Meanwhile, The New York Fed's yield-curve model gives a 50% probability to the U.S. entering a recession over the next 12 months.

Should such a change in market fortunes come to pass ... Well, that's where Dow Jones stocks come in.

Dow Jones stocks ranked

This collection of industry-leading companies and dividend growth stalwarts with their fortress-like balance sheets can offer relative stability in tempestuous market times. From the best Dow dividend stocks to the most widely held blue chip stocks, components of the industrial average occupy top spots in the portfolios of hedge funds and billionaire investors. Warren Buffett's Berkshire Hathaway (BRK.B), in particular, is a huge fan of select Dow stocks.

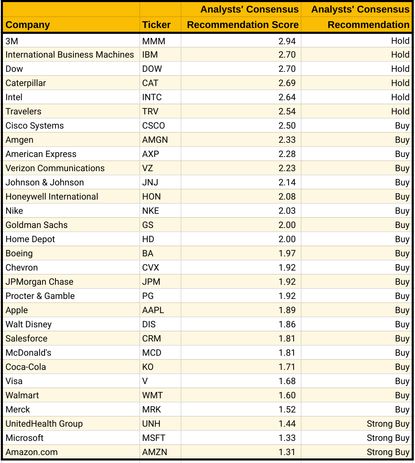

To get a sense of which Dow Jones stocks Wall Street recommends at an increasingly uncertain time for equities, we screened the DJIA by analysts' consensus recommendations, from worst to first, using data from S&P Global Market Intelligence.

Here's how the ratings system works: S&P surveys analysts' stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Scores between 3.5 and 2.5 translate into Hold recommendations. Scores higher than 3.5 equate to Sell ratings, while scores equal to or below 2.5 mean that analysts, on average, rate shares at Buy. The closer a score gets to 1.0, the higher conviction the Buy recommendation.

Note that Amazon.com (AMZN) was added to the Dow in late February, replacing Walgreens Boots Alliance (WBA).

See the table below for analysts' consensus recommendations on all 30 Dow Jones stocks, per S&P Global Market Intelligence, as of May 29, 2024.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade stocks or other securities. Rather, he dollar-cost averages into cheap funds and index funds and holds them forever in tax-advantaged accounts.

-

The Secret Credit Card for Amazon Prime Day Shopping

The Secret Credit Card for Amazon Prime Day ShoppingThis "secret" credit card for Amazon Prime Day shopping can maximize your cash back rewards. Plus get a $300 bonus.

By Erin Bendig Published

-

This Trust Can Protect Your Assets From Long-Term Care Costs

This Trust Can Protect Your Assets From Long-Term Care CostsA Medicaid asset protection trust can help ensure your protected assets go to your beneficiaries rather than your long-term care, but it has to be set up properly.

By Joe F. Schmitz Jr., CFP®, ChFC® Published

-

Stock Market Today: Markets Surge on Dovish Remarks From Powell

Stock Market Today: Markets Surge on Dovish Remarks From PowellThe S&P 500 topped 5,600 for the first time ever, boosted by mega-cap tech stocks.

By Dan Burrows Published

-

Stock Market Today: Markets Hover Near Record Highs on Powell Testimony

Stock Market Today: Markets Hover Near Record Highs on Powell TestimonyStocks were little changed on light volume as the Fed chief testified before Congress.

By Dan Burrows Published

-

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings Loom

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings LoomStocks wavered on light volume ahead of a busy week for economic news and corporate earnings.

By Dan Burrows Published

-

Five Stocks With Solid Growth History and a Promising Outlook

Five Stocks With Solid Growth History and a Promising OutlookFive reasonably priced stocks with solid growth history and a good chance of delivering earnings even if the economy softens.

By Kim Clark Published

-

Why You Should Invest in Commodities

Why You Should Invest in CommoditiesThese portfolio diversifiers are in a long-term uptrend and show why you should invest in commodities

By Anne Kates Smith Published

-

Now's a Great Time to Build a Bond Ladder

Now's a Great Time to Build a Bond LadderNavigating how to proceed with new or rollover money can be daunting. Here are some of the best ways to guarantee a high yield to maturity and full recovery of principal.

By Jeffrey R. Kosnett Published

-

What's the Most Popular Investment? These Investors Might Be Missing Out

What's the Most Popular Investment? These Investors Might Be Missing OutThe most popular investment may shock you and it has widely underperformed other asset classes. Here’s what you need to know.

By Joey Solitro Published

-

Stock Market Today: S&P 500 and Nasdaq Hit Records as Jobs Growth Slows

Stock Market Today: S&P 500 and Nasdaq Hit Records as Jobs Growth SlowsAn uptick in the unemployment rate amid a cooling labor market could accelerate the Fed's rate-cut timeline.

By Dan Burrows Published